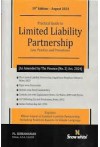

- Author(s): P.L. Subramanian

- Publisher: Snow White Publications Pvt Ltd

- Edition: 19 Ed Aug. 2024

- ISBN 13 9788119637584

- Approx. Pages 896 + contents

- Format Paperback

- Approx. Product Size 24 x 18 cms

- Delivery Time 3-5 working days (within Kerala & South India) (Others 7-9 days)

- Shipping Charge Extra (see Shopping Cart)

.........................................................................................................................

Description

• Topic-wise Discussion

• Section-wise Brief Commentary

• Contains Act with Explanatory Notes, LLP Rules, 2009 with Forms

• LLP (Winding Up and Dissolution) Rules, 2012

• Partnership Act, 1932

.........................................................................................................................

Contents

Part 1 : Practical Guide

1. Introduction

2. Salient Features Limited Liability Partnership

3. Comparison with Partnership and Company

4. Limited Liability Partnership Agreement

5. Registration of LLP and Starting the Business

6. Conversion of Partnership into Limited Liability Partnership

7. Conversion of Private Limited Company into Limited Liability Partnership

8. Conversion of Unlisted Company into Limited Liability Partnership

9. Designated Partners

10. Admission, Resignation, Removal of Partner and Transfer of Interest

11. Change of Registered Office and Name

12. Foreign Limited Liability Partnerships

13. Accounts and Annual Return

14. Electronic Filing of Documents and Returns

15. Audit

16. Investigation

17. Compromise, Arrangement or Reconstruction

18. Income Tax and Limited Liability Partnership

19. Capital Gain and Limited Liability Partnership

20. Tax Implications of Conversion of Company into LLP

21. Alternate Minimum Tax

22. Foreign Direct Investment

23. Closing down of LLP by declaring it as defunct

24. Winding Up and Dissolution

25. Adjudication of Penalties

26. Compounding of Offences

27. Special Court

Part 2 : The Limited Liability Partnership Act with Comments and Statement

of Objects and notes of clauses and Indian Partnership Act, 1932

1. The Limited Liability Partnership Act, 2008

2. The Indian Partnership Act, 1932

Part 3 : The Limited Liability Partnership Rules, 2009 and Forms

1. The Limited Liability Partnership Rules, 2009 and Forms

Part 4 : The Limited Liability (Winding up and Dissolution) Rules, 2012

The Limited Liability Partnership (Winding up and

Dissolution) Rules, 2012

Part 5 : IMPORTANT CIRCULARS

1. Tax Deduction to Start-up and Limited Liability Partnership

2. Use of word 'National' in the names of Companies or Limited

Liability Partnerships (LLPs)

3. Whether Hindu Undivided Family (HUF)/its Karta can become partner/Designated

Partner (DP) in Limited Liability Partnership (LLP)

4. No Objection Certificate (NOC) from the concerned

regulator/Institute for LLP Name approval/incorporation.

5. Chartered Accountants, Company Secretaries And

Cost Accountants can form Limited Liability Partnership.

6. Council Guidelines for Conversion of CA Firms into LLPs

7. Guidelines for Conversion of Cost Accountants' Firms

(Partner ship/Proprietary) into Limited Liability Partnerships (LLPs)

8. Attention Practising Company Secretaries.

9. Notification dated 30th January, 2020

10. LLP Settlement Scheme, 2020 - General Circular No. 6/2020, dated 4-3-2020

.........................................................................................................................

Author Details

PL. Subramanian : B. Com., A.C.A., C.A.I.IB.