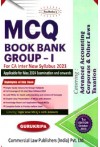

- Author(s): CA G Sekar

- Publisher: Commercial Law Publishers (India) Pvt Ltd

- Edition: 1 Ed Oct. 2023

- ISBN 13 9789356035669

- Approx. Pages 504 + contents

- Format Paperback

- Approx. Product Size 27 x 21 cms

- Delivery Time 3-5 working days (within Kerala & South India) (Others 7-9 days)

- Shipping Charge Extra (see Shopping Cart)

Covering : Advanced Accounting, Corporate & Other Laws and Taxation

......................................................................................................................................

Description

• Single Handy Volume for Group-I Subjects

• Full Coverage of CA Inter New Syllabus 2023

• Lucid MCQs for Quick understanding and revion of Concepts

• Chapter-wise Presentation of MCQs with Anders

• Knowledge-Based and Application-Based MCQS

• Complete Guide to Practice before Exam

• Covering Topic wise MCQ's with Answers

......................................................................................................................................

Table of Contents

A. ADVANCED ACCOUNTING

Formulation & Applicability Of AS

Conceptual Framework

AS 1 Disclosures Of Accounting Policies

AS 2 Valuation Of Inventories

AS 3 Cash Flow Statements

AS 4 Events Occurring After The B/S Date

AS 5 Net Profit Or Loss For The Period, Prior Period Items & Accounting Policies

AS 7 Construction Contracts

AS 9 Revenue Recognition

AS 10 Property, Plant & Equipment

AS-11 The Effects Of Changes In Foreign Exchange Rates

AS-12 Accounting For Govt Grants

AS 13 Accounting For Investment

AS 15 Employee Benefits

AS 16 Borrowing Costs

AS 17 Segment Reporting

AS-18 Related Party Disclosures

AS-19 Leases

AS-20 Earnings Per Share

AS-22 Accounting For Taxes On Income

AS-24 Discontinuing Operations

AS-25 Interim Financial Reporting

AS-26 Intangible Asset

AS-28 Impairment Of Assets

AS-29 Provisions, Contingent Liabilities And Contingent Assets

Branch Accounts

Shares - Redemption & Buyback

Final Accounts Of Companies

Internal Reconstruction

Accounting For Amalgamations

Consolidation of subsidiaries (AS 21 consolidated financial statements)

AS-23 accounting for investments in Associates

AS-27 Financial Reporting of interests in Joint ventures

B. CORPORATE AND OTHER LAWS

A. Companies Act-Overview

B. Company-Basic Concepts

Incorporation of Company

Memorandum and Articles of Association

Prospectus

Shares-Issue and Allotment

Shares-Forfeiture, Surrender, Reduction & Buy-Back

Membership, Transfer of shares, Registers & Returns

Company General Meetings

Debentures, Deposits and Charges

Other Matters and Company Law in e-Environment

Dividends-Declaration and Payment

Account of Companies

Audit and Auditors

Foreign Company and Other Companies

Limited Liability Partnership

Foreign Exchange Management Act, 1999

The General Clauses Act

Interpretation of Statues

Comprehensive Case Scenario based Multiple Choice Questions.

C. TAXATION

Basic concepts in Income Tax Law

Residential status and taxability in India

Exemptions under Income Tax Act

Income from Salaries

Income from House property

Profits and gains of Business or Profession

Capital Gains

Income from other sources

Income of Other persons included in Total Income

Setoff and Carry Forward of Losses

Deductions under Chapter VI-A

Rebate and Relief, Advance Tax and Interest

Agricultural Income

Taxation of Individuals

Taxation of HUF

Return on Income

Tax Deducted at Source

Goods and Services Tax

A Basic Concepts of GST

B GST-Levy and Collection of Tax

GST - Exemptions

Time Value and Place of Supply

Input Tax Credit

Registration

Tax Invoice, Credit and Debit Notes

Payment & Returns

Accounts and Records

Comprehensive Case Scenario based Multiple Choice Questions.

......................................................................................................................................

Author Details

G. Sekar